Today’s economic environment has welcomed unforeseen and horrendousrealities that even the best planning entrepreneur could not have predicted. With the closures of businesses, the changes in traffic and activity, and the reduced income faced by many consumers businesses are having to plan how to proceed to ensure that their business will be able to continue on to a post coronavirus lockdown phase of operations. In order to bridge the gap from what was normal operations to the new normal many business will need to take advantage of imperative financing alternatives to assist in ensuring the longevity of their business and its operations. Choosing carefully the best loan product for the business will be equally important as different loan products focus on different needs and sectors and the acceptance of one will have a definitive impact on the ability to access others. In order to make the best decision for both the short and long term there are some important must to do’s business must first prepare to best plot a course to fit with a loan product.

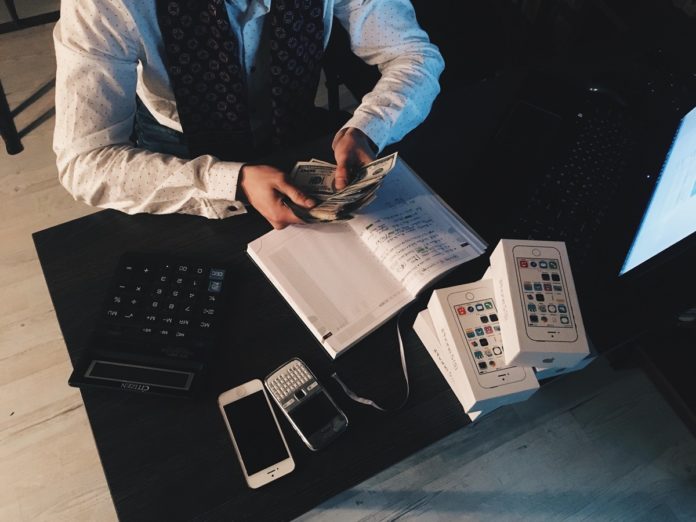

- Financial Review Preparedness: While there is a lot of buzz about easy and streamlined loan applications, certain document requests consistently remain the same. Before applying for any loan make sure you first prepare your financials, both personal and business, for review. Any lender will want to make sure you not only full understand where you stand financially but that you have clear and transparent financial records. Take the time you need to catch up on any accounting for your balance sheet, profit and loss and even your personal financial statement. Typically banks will want to know pre-impact that your business was doing well and it is anticipated that the business can service the debt created by the loan.

- Tax Returns Submissions: No matter how good or bad your business was doing before the impact of the virus hit the best way for banks to determine your position is your tax returns. This is because these documents have been presented and verified as to your income. It can avoid anomalies of setbacks or surges and gives a historical history that can be mapped as to the feasibility of your business. I have yet to see an application that was not paired with this document production request. Be aware that if you do not have tax returns for two years you may still qualify but not for every lender. Be up front with what you have and make sure to ask the critical questions that apply to your situation.

- Plan for the future: Where you go from here will be another critical component. While there is a lot of the timeframes that are unknown known the most prudent path is to prepare for all scenarios. Presenting a bank with your anticipated cash flows taking into account for short and long term variables tell a strong story of your preparedness and ability to perform under the terms of the loan in these uncertain times.